Part 3: New England Needs Natural Gas

in Order to Fully and Swiftly Retire 8,300 MW of “At-Risk” Coal- and Oil-Fired

Generation Capacity

As detailed

in Parts 1 and 2, New England is facing a current energy crisis. The solution is adding natural gas pipeline

capacity to the region as soon as possible, coupled with investments in energy

efficiency and renewables. However, the

current crisis could get much worse with the anticipated retirement of almost

one quarter of the New England’s existing electric generation capacity.

The regional

grid operator, ISO New England (ISO), has initiated a “Strategic Transmission Analysis” to shed light on the expected retirement

of 8,300 MW of existing coal- and oil-fired generation capacity. More specifically, ISO sought to:

- “Evaluate the reliability impacts associated with the retirement of 28, 40+ year-old coal- and oil-fired resources by 2020” and

- “Determine whether these retirements totaling 8.3 GW pose transmission security or resource adequacy issues.”

The

generation capacity that ISO identified to be “at risk” is inefficient,

expensive, highly polluting, and far past its useful life:

The Strategic Transmission Analysis determined that New England would be challenged to meet its 2020 Installed Capacity Requirement (detailed in Part 2) “absent replacements, repowering or the addition of new resources.” To reach this conclusion, ISO evaluated 3 scenarios:

- Scenario 1: Existing generation with no new generation

- Scenario 2: At-risk resources replaced at the Hub, and critical resources are retained at existing sites

- Scenario 3: At-risk resources are replaced at the Hub, and critical resources are repowered at existing sites

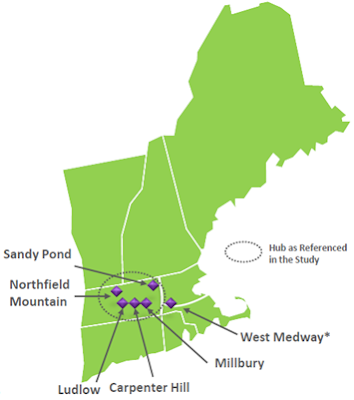

The “Hub” is an area of the regional electric grid located western and

central Massachusetts framed by major electric infrastructure such as

high-voltage transmission lines and substations. Because of this infrastructure, the Hub is an

electrically unconstrained area of the grid, meaning that power generated

within or delivered to this infrastructure can be reliably dispersed to almost

all parts of the New England system under most grid operating conditions. Because

generation located at or interconnected with the Hub is in the unconstrained

“Rest of Pool” pricing region, cheaper generation located here will have the maximum

price-lowering impact for New England.

In Scenario

1, ISO found “no more than 950 MW may be retired without causing reliability

problems.” This means that despite it

being uneconomic and harmful to the environment for old coal- and oil-fired

generators to operate, ISO could allow only 950 MW of 8,300 MW to retire. It would be forced to offer above-market

“reliability-must-run” contracts the remaining 7,350 MW of capacity to entice its

continued operation.

In Scenario

2, ISO found that all “at-risk” generation could retire, except 1,350 MW at

critical resource sites. System

transmission constraints would require “at-risk” resources to remain

operational in Connecticut and southeastern Massachusetts. In order to retire 6,950 MW of “at-risk”

capacity, however, up to 5,100 MW of replacement resources would be required to

be constructed at, or integrated with, the Hub.

In Scenario

3, ISO found that all “at-risk” generation could reliably retire if 400 MW was

repowered in Connecticut, 500 MW was repowered in southeastern Massachusetts,

and approximately 5,100 MW of new generation capacity was constructed at, or

integrated with, the Hub.

The simple

upshot of ISO’s study, which included 800 MW of efficiency being added, is that

if New England wants to safely retire 8,300 MW of aging coal- and oil-fired

generation capacity, it must construct at least 5,900 MW of new generation. Of the 5,900 MW, 900 must be specifically

sited in Connecticut and Massachusetts due to electric transmission

constraints. The remaining 5,000 MW

should be constructed at, or integrated with, the Hub. Constructing at the Hub reduces the need to

build transmission to the Hub. Once

electricity gets to the Hub, it can flow unconstrained to all parts of New

England. “If substitute resources are not available, only 950 MW of the

existing 8,300 MW of older oil and coal resources will be able to retire without

causing reliability problems.”

How

to Meet the Recognized Need for 5,900 MW of New Generation

As

previously discussed in Part 2, generation technologies have different

attributes. Coal and oil should be off

the table for their cost and environmental impact. Wind and solar are intermittent and cannot

provide energy on-demand. Moreover,

there is little or no wind potential in central Massachusetts. It is unlikely that nuclear capacity will be

constructed in New England in the intermediate future due to fierce

opposition. Hydro resources have been

declining in New England, as some environmental groups advocate for

free-flowing rivers and fight to remove many dams. Moreover, there are no large rivers flowing

through central Massachusetts. What’s left? The answer is natural-gas-fired generation,

which happens to have the suite of attributes necessary for further integration

of intermittent renewable energy. Thus,

New England needs to ensure that any new natural-gas fired generation has

access the sufficient natural gas pipeline capacity to ramp to full levels when

needed. Increasing reliance on wind and

solar will magnify the need for increased natural gas pipeline capacity capable

of reliably serving existing and new natural gas-fired generation capacity on a

no-notice basis.

New

gas-fired generation will initially serve in a base-load (running most of the

time) or intermediate (following predictable demand) role to replace existing

coal- and oil-fired units. In the longer

term, with increasing renewable penetration, these units, and the natural gas

pipeline capacity that serves them, will be needed to serve a ramping and

balancing function to smooth out variable wind, solar, and hydro production.

What Pipeline Projects

are Best-Suited to Supply the Hub, Lower Cost, and Balance Renewables?

The Tennessee gas Pipeline Company,

L.L.C.’s “Northeast Energy Direct”

project is configured in a way that will maximize the ability to, and minimize

the cost of, expanding gas-fired generation at and near the Hub and provide the

flexible infrastructure in the long-term that will allow such new generation to

reliably serve its future ramping and balancing function for renewables. The Northeast Energy Direct project, along

with the existing Tennessee Gas Pipeline, would closely track the contours of

the Hub, and over 90% of it would be co-located along existing utility

corridors (e.g., where electric transmission already exists).

However, the

convenience of the Northeast Energy Direct for Hub-based generation does not

mean other proposed pipelines are not important. Spectra Energy’s proposed “Access Northeast”

project, located in New Jersey, New York, Connecticut, Rhode Island and

Southern Massachusetts, is important too because it will help to eliminate New

England’s gas pipeline capacity deficiency and serve local distribution gas

companies and generators.

In a future post, I will detail how much pipeline capacity is needed to substantially reduce or eliminate New England’s pipeline capacity deficit, and thus reduce our electricity and natural gas prices to levels enjoyed everywhere else in the country.

Conclusion:

To attain

the three goals of: (1) reducing energy costs; (2) increasing efficiency and

renewables; and (3) eliminating coal- and oil-fired generation, New England

desperately needs natural gas pipeline capacity. Natural gas pipeline constraints, not the

price of the commodity, are imposing a multi-billion dollar annual “energy tax”

on electricity consumers and revitalizing the region’s antiquated coal- and

oil-fired generators. Energy efficiency

and renewables will help, but not to the extent New England needs to lower

costs. Further, from a grid reliability

standpoint, increasing intermittent energy from solar and wind will require

additional pipeline capacity to ensure the region’s fleet of natural-gas-fired

generators can ramp up to full output when the wind is not blowing and the sun

is not shining, especially in the middle of winter. If the region finally wants to retire the

remaining 8,300 MW of coal- and oil-fired generation, over 5,000 MW of

generation must be constructed, some of which must be fueled with natural gas,

and most of which should be located at or near the Hub to enhance grid

reliability and have the greatest price-suppression effect.